E-commerce in India is expanding at a rapid pace and the customers are currently demanding efficient, secure and convenient checkout process whenever they make any purchase on the internet. You have a small online store, you have a D2C brand or a full-scale online ecommerce site, and it is very important to select the appropriate payment gateway. Performing the role of collecting money is only a part of what a payment gateway does, as it also influences customer trust, conversion rates, and the speed of receiving a payment in your business.

India has a number of trustworthy payment gateways that accept UPI, credit and debit cards, net banking, EMI as well as digital wallets. However, it can be difficult to choose the most suitable payment gateway when there are so many options in the market to choose. This blog hosts the breakdown of the best payment gateways in India, their features, price, advantages, and best applications.

Razorpay is also among the most famous payment gateways in India, which has gained the trust of both large and small-sized ecommerce stores. It helps to accept more than 100 modes of payment such as UPI, credit cards, debit cards, net banking, EMI and popular wallets.

Key Features:

Simple webshop integrates with ecommerce solutions such as Shopify, WooCommerce and Magento.

Why E-commerce Sellers prefer Razorpay ?

Razorpay has one of the most convenient checkout experiences in India. Razorpay will make a good option in case your business receives large amounts of UPI payments and the failures are minimal.

Cashfree is rated to settle within the shortest possible time and pay out bulk, which makes it suitable to ecommerce companies with many vendors involved or COD settlements.

Key Features:

Why Choose Cashfree?

In case your ecommerce enterprise is a COD order-based or demands fast payment to the suppliers, Cashfree proves to be a very efficient solution.

Growing ecommerce brands have embraced PayU due to its high success rate and great security of payments.

Key Features:

Who Should Use PayU?

PayU is also perfect when the sellers desire to have a stable, user-friendly payment system and customer support of excellent quality.

CCAvenue is a reputed and the oldest payment gateway in India that has the most diverse range of payment options.

Key Features:

Why It Works for Ecommerce?

The multilingual checkout of CCAvenue has enabled its application in companies with operations in various parts of India.

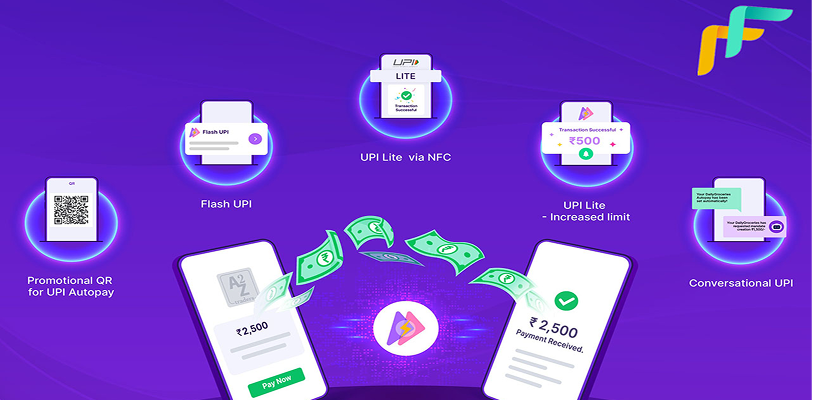

One of the best UPI programs in India is PhonePe, and its payment gateway is currently popular among the ecommerce retailers.

Key Features:

Who Should Use It?

In case the majority of your consumers use UPI, the gateway offered by PhonePe has one of the highest success rates in the country.

The choice of the appropriate payment gateway will be dependent on the size of your business, customers and the volume of transactions. The following are some of the main considerations:

The most appropriate payment gateway for your ecommerce business in India will depend on what you require specifically, like a quick settlement system, an easy UPI or a low cost or a more advanced system. The options of Razorpay, Cashfree, PayU, CCAvenue and PhonePe Payment Gateway are all great ones that thousands of Indian businesses are confident in.

However, the process of payment is not the only aspect of an ecommerce business. Invoices, payments, inventory and reports are also important to manage.Securing a robust, all-in-one management system to work alongside a trusted payment gateway is the ideal strategy to handle your accounts easily, stay organized, save time, and efficiently expand your e-commerce business in India.

USA

UK

CHINA

Dubai

Arrow Thought with world-class tech teams We’ll match you to an entire remote team of incredible freelance talent.